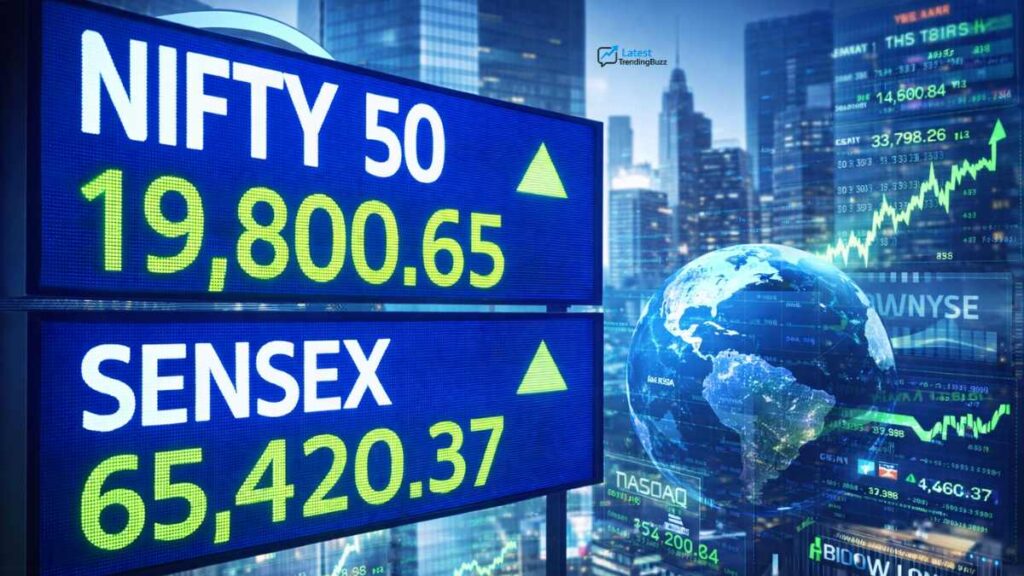

Nifty & Sensex rally worldwide headlines marked the opening days of 2026 as global equity markets surged on renewed investor confidence, easing inflation concerns, and optimism around economic growth. Indian stock benchmarks joined a broad-based rally across Asia, Europe, and the United States, reflecting strong risk appetite at the start of the new year.

Market participants say the upbeat momentum signals a positive outlook for equities, driven by expectations of stable interest rates, improving corporate earnings, and resilient global demand.

Also Read: 6.5 Magnitude Earthquake Shakes Southern Mexico — Damage Reported

Nifty & Sensex Rally Worldwide as Investors Turn Optimistic

Indian equity markets opened 2026 on a strong note, with benchmark indices posting significant gains in early sessions. The rally was supported by buying across key sectors, including banking, IT, energy, and automobiles.

Analysts noted that foreign institutional investors (FIIs) showed renewed interest in Indian equities after months of cautious positioning. Domestic institutional investors also remained active, providing stability to the market during early-year trading Nifty & Sensex rally worldwide.

Global Markets Rally in Sync With India

The Nifty & Sensex rally worldwide mirrored strength seen across major global markets. Asian equities gained as investors reacted positively to signs of economic stabilization, while European markets opened higher amid improving business sentiment. Wall Street also posted gains, extending the momentum from late 2025 into the new year.

Key global drivers behind the rally include:

- Expectations of slower interest-rate hikes by major central banks

- Signs of cooling inflation in advanced economies

- Stronger-than-expected corporate earnings outlooks

- Improved global trade and supply-chain stability

This synchronized rally reflects a broader shift toward risk-on sentiment in global financial markets.

Sector-Wise Performance Fuels Nifty & Sensex Rally Worldwide

The rally in Indian markets was broad-based, with several sectors contributing to the upward move Nifty & Sensex rally worldwide:

- Banking & Financials: Gains driven by stable interest margins and strong credit growth

- IT Stocks: Supported by a stable global demand outlook and currency movements

- Energy & Infrastructure: Boosted by government spending expectations

- Automobiles & FMCG: Benefiting from steady domestic consumption trends

Market experts believe that sectoral participation strengthens the sustainability of the rally.

Role of Macroeconomic Stability

India’s macroeconomic fundamentals played a key role in supporting the Nifty & Sensex rally worldwide. Stable inflation levels, manageable fiscal indicators, and consistent GDP growth projections have reinforced investor confidence.

Additionally, expectations around policy continuity and reforms have added to market optimism. Investors are closely watching upcoming economic data and policy signals for further confirmation of growth momentum.

Global Policy Outlook Supports Market Sentiment

Globally, central banks are expected to adopt a more measured approach in 2026 compared to the aggressive tightening cycles of previous years. This outlook has reduced fears of sharp economic slowdowns and encouraged equity investments.

Market strategists say that clarity around monetary policy paths is helping investors plan longer-term allocations, particularly in emerging markets such as India.

Investor Sentiment and Market Volatility

While the Nifty & Sensex rally worldwide has boosted sentiment, analysts caution that volatility could persist due to:

- Geopolitical developments

- Commodity price fluctuations

- Changes in global interest-rate expectations

However, most experts agree that short-term corrections, if any, are likely to be healthy and may provide buying opportunities for long-term investors.

Also Read: lash Floods in Afghanistan Kill Dozens, Homes Destroyed

What This Means for Investors in 2026

The strong start to 2026 has reinforced expectations that equities could remain a preferred asset class this year. For Indian markets, sustained foreign inflows, stable domestic demand, and earnings growth will be key factors to watch.

Investors are advised to:

- Maintain diversified portfolios

- Focus on fundamentally strong stocks

- Avoid overreacting to short-term market swings

Long-term outlook remains positive, supported by structural growth trends.

Conclusion

The Nifty & Sensex rally worldwide underscores a renewed wave of optimism sweeping across global financial markets at the beginning of 2026. With supportive macroeconomic signals, improving global sentiment, and broad-based participation across sectors, markets have started the year on a confident note.

As global and domestic factors continue to align, investors remain hopeful that this positive momentum will extend further into 2026, even as they stay cautious of evolving risks.