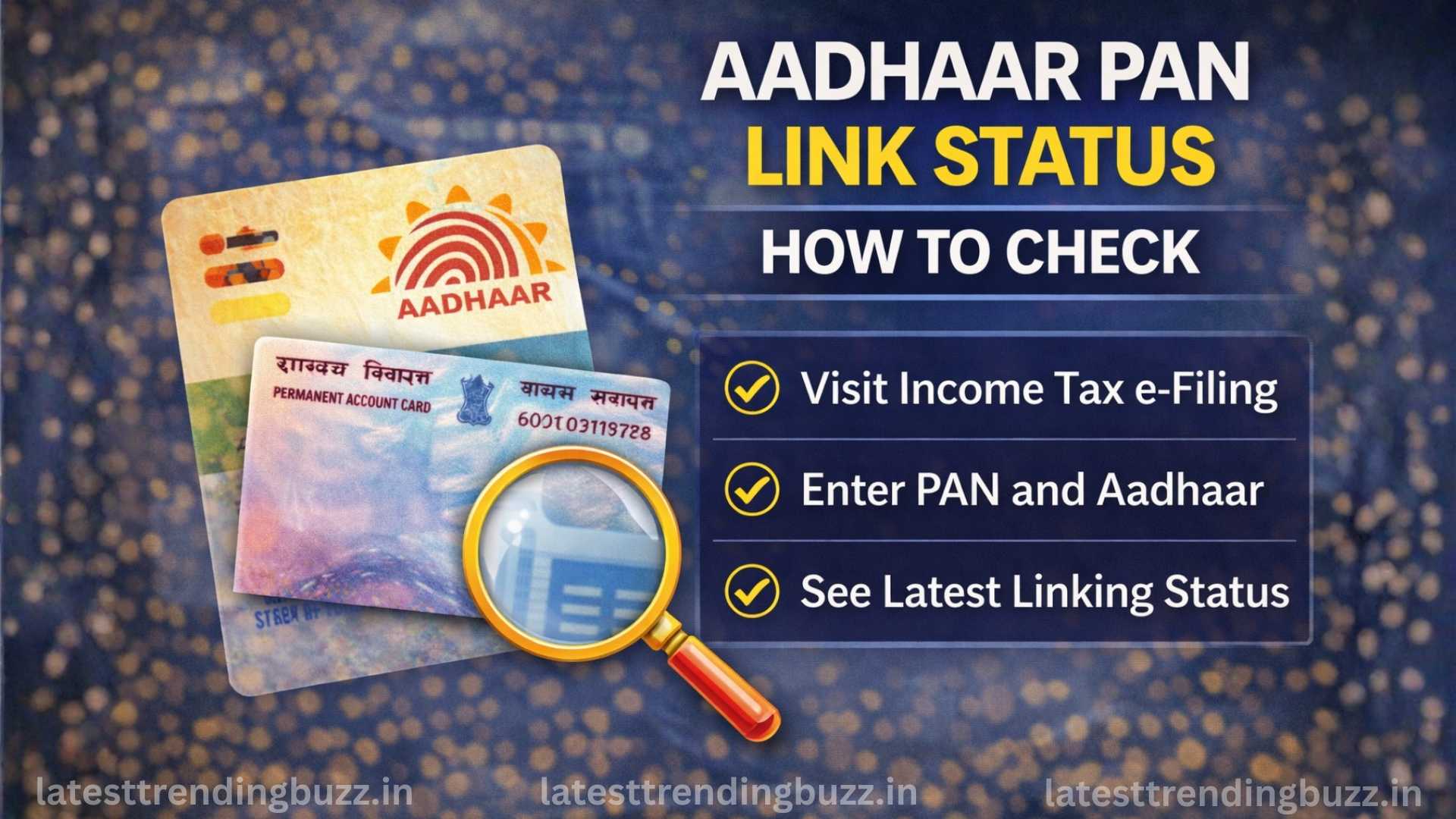

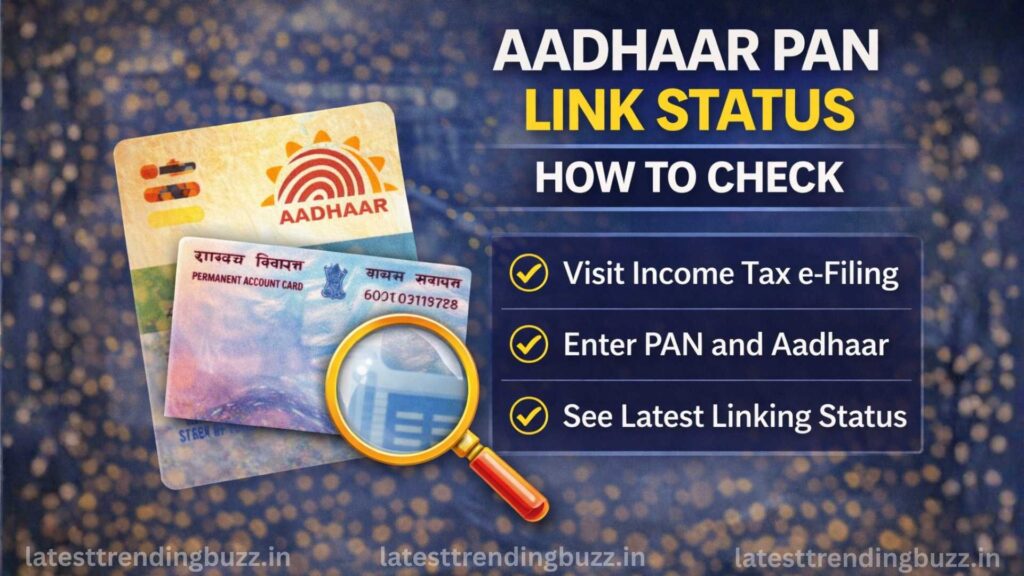

Aadhaar PAN link status can be checked online through the official Income Tax Department portal. This helps taxpayers confirm whether their PAN is successfully linked with Aadhaar or not.

Checking the aadhaar pan link status is important because an unlinked PAN can become inoperative, affecting income tax returns, banking transactions, and financial compliance.

This update impacts all PAN card holders in India, especially those who have not yet confirmed their linking status.

Latest Update on Aadhaar–PAN Linking

The Income Tax Department has enabled a simple online facility to check aadhaar pan link status without logging into an account. Users only need their PAN and Aadhaar numbers to verify the status.

If PAN and Aadhaar are not linked, taxpayers may be required to pay a late fee before completing the linking process, as per current tax rules.

Authorities have advised citizens to verify their status early to avoid inconvenience during financial transactions.

Also Read: Rape Charge on BJP Leader Husband Today: Case Details and What Happens Next

Key Details at a Glance

- Service available on: Income Tax e-Filing portal

- Details required: PAN number and Aadhaar number

- Status types: Linked / Not linked / Linking in progress

- Late fee (if applicable): As prescribed by tax rules

- Impact of non-linking: PAN may become inoperative

Who Is Affected or Impacted

- Individuals filing income tax returns

- Salaried employees and self-employed professionals

- Bank account holders using PAN for KYC

- Investors using PAN for mutual funds, stocks, or property

The aadhaar pan link status check is essential to ensure uninterrupted financial and tax-related activities.

What People Should Do Now

- Visit the official Income Tax e-Filing website

- Use the “Link Aadhaar Status” option

- Verify whether PAN is linked with Aadhaar

- Complete linking immediately if status shows “Not linked”

- Save confirmation for future reference

Delaying action may lead to PAN becoming inactive.

Also Read: TS TET Hall Ticket Download 2026 — Direct Link, Exam Date & Steps

Official Source and Context

The Income Tax Department of India provides the aadhaar pan link status facility through its official portal. The linking requirement is mandated under income tax laws to improve transparency and reduce duplicate PAN usage.

Officials have stated that PAN–Aadhaar linking ensures smoother tax administration and compliance.

Frequently Asked Questions

How can I check my aadhaar pan link status online?

You can check it on the Income Tax e-Filing website using your PAN and Aadhaar number.

What happens if PAN is not linked with Aadhaar?

Your PAN may become inoperative, affecting tax filing and financial transactions.

Is login required to check Aadhaar PAN status?

No. The status can be checked without logging in.

Can I link Aadhaar with PAN after the deadline?

Yes, but a late fee may be applicable as per current rules.

Also Read: Digvijaya Singh Latest Update Today: Key Statement, Impact Explained

Conclusion

Why is checking aadhaar pan link status important?

It ensures your PAN remains active and usable for tax and financial purposes.

What should taxpayers expect next?

Taxpayers should expect stricter enforcement of PAN validity rules, making timely verification and linking essential.

Disclaimer

This article is based on official announcements, publicly available information, and media reports at the time of publication. Readers are advised to verify details from official sources.